Apple’siPhone has achieved record-high sales volume for a third quarter of the year, while the global smartphone market continues to recover.

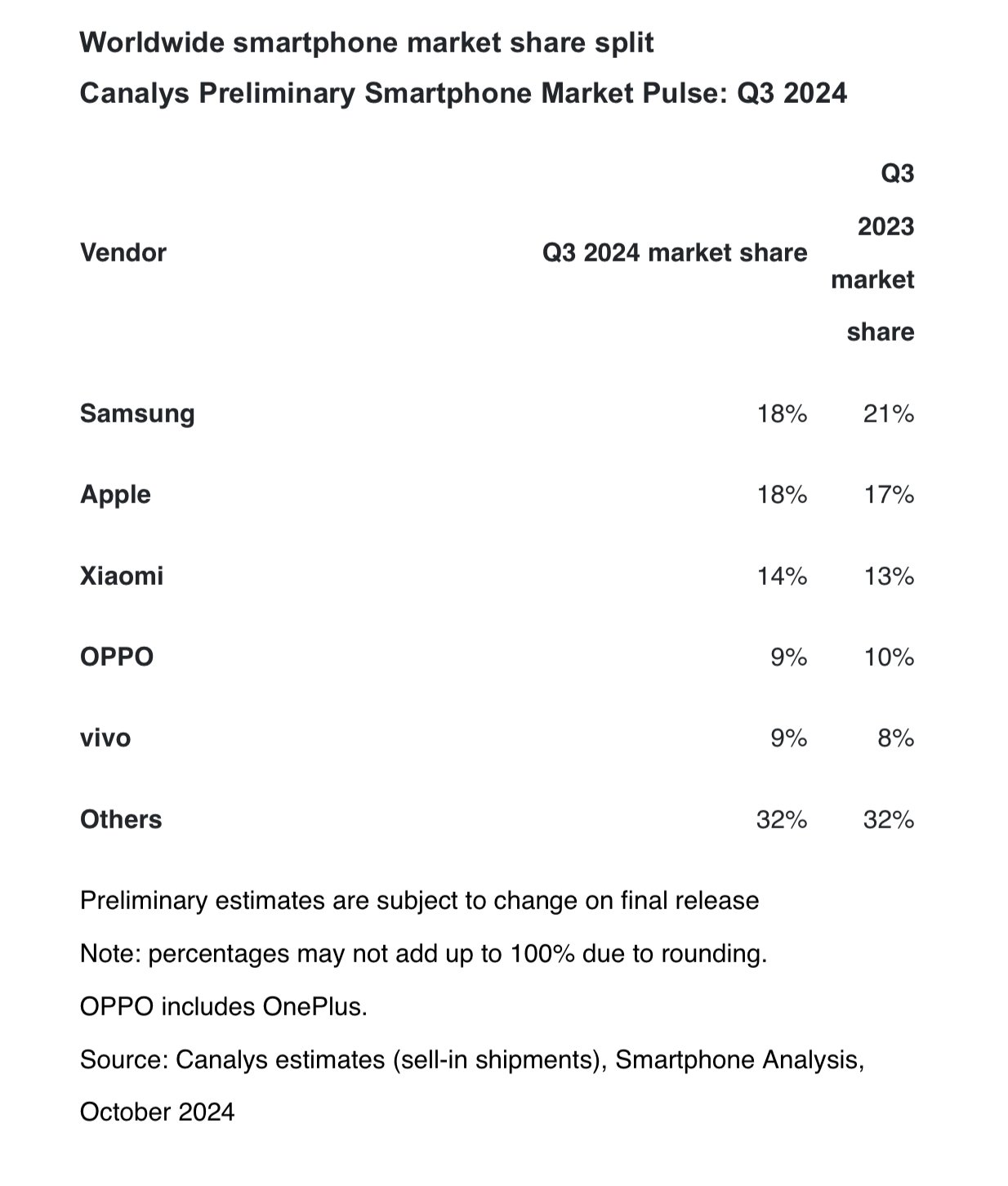

The two firms were so close that Canalys actually lists them both as having 18% market share, but says Samsung’s sales saw it “narrowly defending its pole position.” Apple’s 18% is a 1% improvement year over year from Q3 2023, but Samsung’s is a fall of 3% in the same period.

Significantly, Samsung launched its latest smartphones in July, at the start of the quarter. Apple’s iPhone 16 range only went on sale on September 13, halfway through the last month of the quarter.

While usually a new smartphone release boost sales at launch, it’s possible that this time the scheduling worked to Apple’s advantage for another reason. Sales of the iPhone 16 range have been lackluster, so only having a short time on sale in Q3 may have helped.

Canalys is still predicting that the iPhone 16 range will give Apple “a strong finish to 2024 and help momentum in H1 2025,” in part because of Apple Intelligence. Nonetheless, the analysts credit the previous model for Apple’s success in Q3.

“Apple achieved its highest third-quarter volume to date and has never been closer to leading the global smartphone market in a Q3 than now,” said Runar Bjorhovde, Analyst at Canalys. “The ongoing strong demand for the iPhone 15 series, along with Apple’s legacy models, played a crucial role in its Q3 performance.”

“The market’s shift towards premium devices, intersected by an ongoing refresh cycle of devices bought during the pandemic, is benefiting Apple,” continued Bjorhovde, “particularly in its strong-hold regions such as North America and Europe.”

Overall, Canalys reports that the global smartphone market rose 5% year over year in Q3 2024. That makes this a fourth consecutive quarter of growth.